Selling on Amazon without a GST (Goods and Services Tax) number in India is possible under specific conditions. Here’s how you can do it:

How to Sell Product on Amazon Without GST Number

NOTE- Also you can sell products from your home (Pack items yourself ) and also you can stock your inventory in amazon FBA (Fulfilled by Amazon).

You can start online product selling business without taking GST number with Amazon in two ways.

One Way

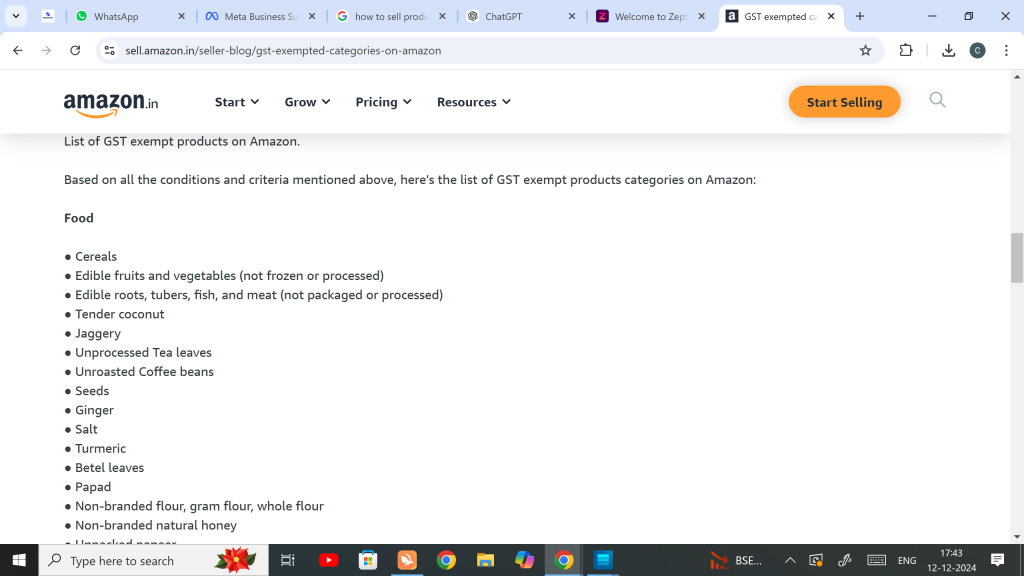

You can start selling those products which come under GST exempted categories (See all categories ).

You just need these documents to start without gst number in exempted categories –

Required Documents

1- Email Id

2- Phone number

3- Pan number (Individual or Business)

4- Bank Account number (Saving or current)

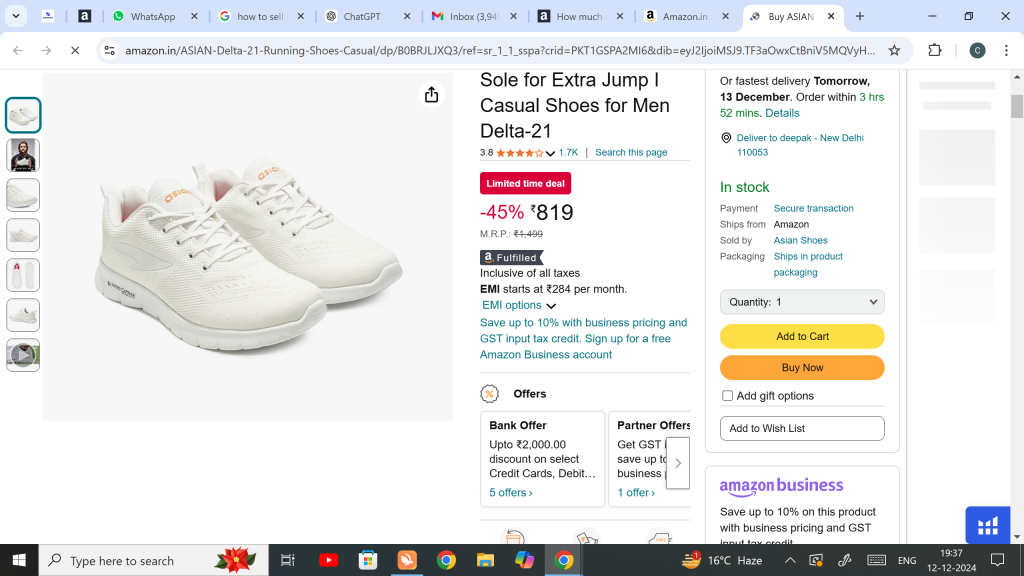

Product Listing –After account creation you can list your products with Product images, Product name, Description MRP, and Selling Price. on amazon.

Orders Shipment- Once order received you can take help of any third party courier company like Indiapost, DHL, FedEx, Shiprocket and more for international shipping

See this video for seller commission – Click on

Second way

Register as an Individual Seller on Amazon

Amazon India allows individuals to sell without a GST number if their business falls under specific exemptions:

Read in details about Individual Seller Criteria-Click here

Steps to Register Without GST as Individual seller

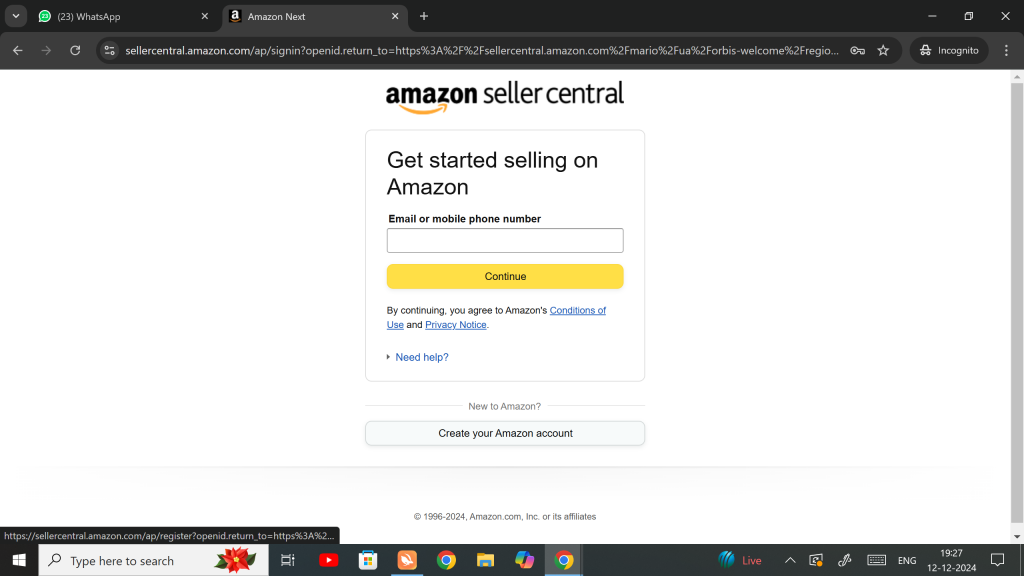

- Create an Amazon Seller Account:

- Go to Amazon Seller Central and click on Create your amazon account.

- Sign up using your personal information, email, and phone number.

- Select ‘Individual Seller’ Option:

- When asked about your business type, choose “Individual.”

- Provide Required Documents:

- PAN card (mandatory for tax purposes).

- Bank account details (for payment).

- Government-issued ID (e.g., Aadhaar, Passport, or Driving License, or Rent Agreement).

- Credit Card or Debit Card (Must be International Active)

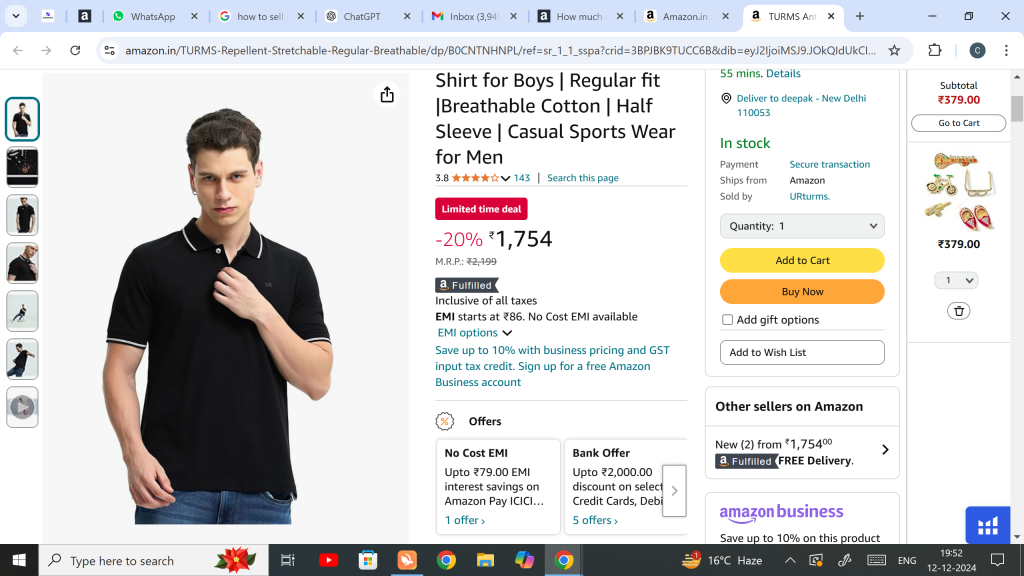

Products Listing- After account creation you can list your products with Product images, Product name, Description MRP, and Selling Price.

Orders Shipment- Once order received you can take help of any third party courier company like Indiapost, DHL, FedEx, Shiprocket and more for international shipping.

Q-1- Can I sell clothes on Amazon without GST

Answer– Yes, you can sell clothes on Amazon without a GST number if your annual turnover is below the GST threshold (₹20 lakh for most states, ₹10 lakh for special category states) and you’re not engaged in interstate sales.

Q-2- Can I sell products without GST?

Answer- Categories Allowed Without a GST Number

If you plan to sell without a GST number, you’ll need to focus on specific product categories. Here are some examples:

Books: Selling physical books is GST-exempt, making it a popular category for GST-free sellers.

Handicrafts and handmade items: Many handicraft products are exempt from GST under certain conditions.

Unprocessed agricultural products: Items like fresh fruits, vegetables, and grains are usually GST-exempt.

Q-3- Can a normal person sell on Amazon?

Answer- Yes, a normal person can sell on Amazon! Whether you’re an individual or a business, Amazon makes it easy to start selling. You just need to create an Amazon seller account, provide basic details like a PAN card and bank account, and list your products. For individuals, there’s no need to register as a company. With low startup costs and access to millions of customers, Amazon is a great platform for anyone looking to start or expand their e-commerce journey.

Q-4- Is it profitable to sell on Amazon?

Answer– Yes, selling on Amazon can be highly profitable if done strategically. With access to millions of customers, advanced tools, and global reach, sellers can achieve significant sales. However, success depends on factors like choosing the right products, competitive pricing, and effective marketing. Costs like Amazon fees, shipping, and advertising should be managed carefully to maximize profits. Many sellers find Amazon profitable when they optimize their operations and focus on customer satisfaction.

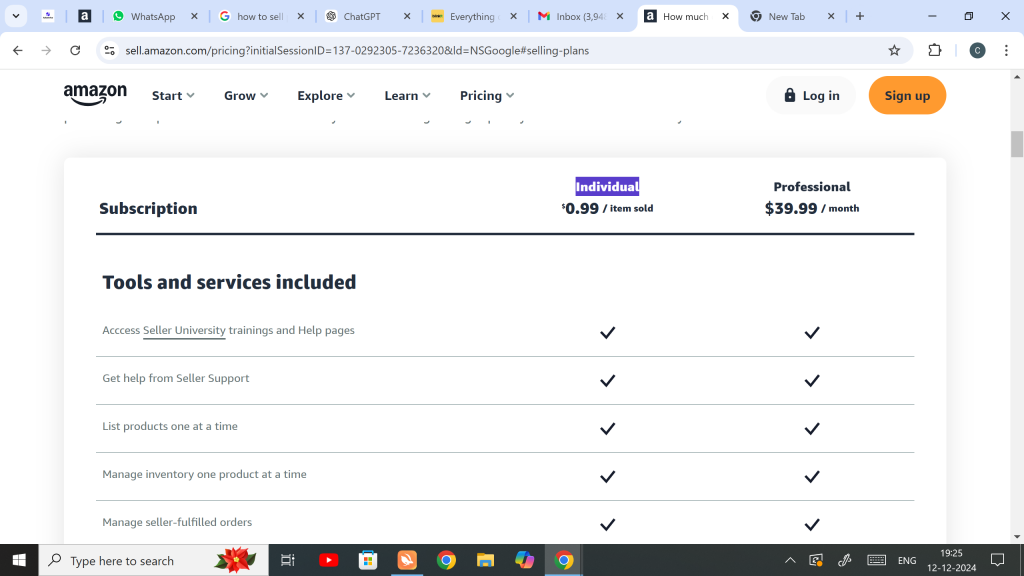

Q-5- How to sell on Amazon for free?

Answer– Selling on Amazon for free is possible with the Individual Seller Plan, which charges no monthly subscription fee. Instead, you pay a small per-item fee when a product is sold. To get started, create a seller account on amazon list your products, and begin selling. While there are some associated costs like shipping and referral fees, you can minimize upfront expenses by managing fulfillment yourself and focusing on no-cost product categories. This is a great option for new or low-volume sellers testing the platform.

Q-5- Where to buy products to sell on Amazon India?

You can buy from Indiamart see more about it click here

Conclusion

Selling on Amazon without a GST number is a viable option for those just starting or focusing on exempt product categories. While it limits your product range and growth potential, it’s a great way to test the waters and build your e-commerce business. As your business grows, obtaining a GST registration will open doors to selling in more categories and scaling operations effectively. Always stay informed about the latest GST regulations to ensure compliance and avoid potential issues.